When I started dealing with my own personal burst pipe claim with Allstate, I quickly realized that I wasn’t actually speaking to any Allstate employees. I was talking to adjusters working with Pilot Catastrophe Services, a third party company that provides independent adjusters for insurance companies such as Allstate and State Farm. My experience in working with the Catastrophe team at Pilot was a nightmare.

In this post, I’ll peel back the layers of that experience, sharing the gritty details of navigating a claim with Pilot Catastrophe Services. From the initial shock of discovery to the frustrating dance of communication, I’ll take you through each step, offering insights and reflections on what it means to fight for what you’re owed, when the system seems stacked against you.

Table of contents

What is a Catastrophe?

In the insurance world, a “catastrophe” is any event that causes significant damage to a large number of properties, such as natural disasters or large-scale accidents. Think things like hurricanes, abnormally cold temperatures, or earthquakes.

These events trigger an overwhelming number of claims, pushing insurance companies to seek additional support. Since these catastrophes don’t happen all the time, insurance companies don’t keep enough adjusters on their payroll. In other words, it’s not cost-effective for companies like Allstate and State Farm to keep enough staff to handle every single claim – sometimes they need additional help where there are a lot of unexpected claims.

Here’s where companies like Pilot Catastrophe Services comes into play, offering the manpower and adjusters needed to handle the sudden surge in claims.

Why Would an Insurance Company Use Pilot?

The reasoning behind outsourcing to firms like Pilot is straightforward: scalability and cost-savings. In times of a catastrophe, insurance companies face a sudden spike in claims, far beyond their normal capacity.

By partnering with Pilot, companies like Allstate can work to handle these catastrophe claims quickly, despite the increased volume. However, this arrangement can sometimes introduce a gap in the personal touch and understanding that policyholders expect.

This all sounds fine in practice, but the reality is that these independent adjusters at Pilot Catastrophe Services work for the major insurance carriers, and have designed a playbook to strategically deny or underpay valid claims.

The Real Problem with Pilot Catastrophe Services

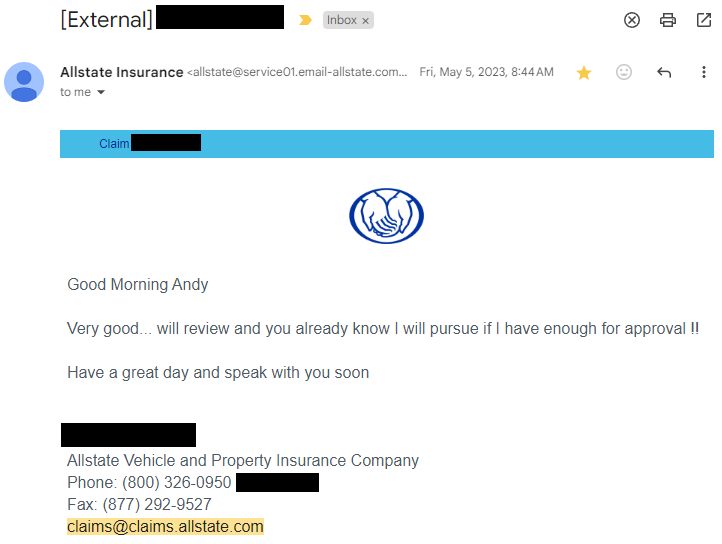

The real problem with Pilot can be boiled down into a few key points. When applicable, I’ve included screenshots of actual communications between me and my Allstate adjusters (almost all of them worked at Pilot Catastrophe Services).

Adjusters at Pilot are Intentionally Overloaded with Claims

During a catastrophe, the insurance companies receive a large influx of claims. Since insurance companies don’t want to pay adjusters to sit around with nothing to do, they typically don’t have enough adjusters on staff to handle all these claims. Adjusters are overwhelmed with claims, meaning that they don’t have time to properly or thoroughly review every single claim.

This means that many things that should be covered go overlooked or underpaid, since the each adjuster might easily be handling over 60-100 claims at the same time! This also means that responses will be delayed.

In my case – there was one point in time where I had to float over $30,000 in approved expenses because Allstate couldn’t find the time to review my receipts within a reasonable amount of time!

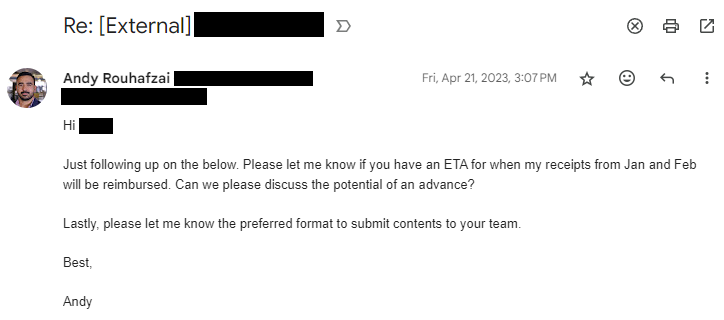

Pilot Adjusters are Impossible to Get on the Phone

Another thing I noticed about the Allstate National Catastrophe Team is that they are nearly impossible to get on the phone, which is a big problem. The pipes in my home burst on December 24, 2022. The first few weeks of a claim like this are crucial, yet I could barely get the adjuster on the phone once in every 3-5 days!

So I resorted to sending emails – a great tactic to make sure everything is kept in writing, and they actually complained that I was sending them too many emails!

The adjusters at Pilot Catastrophe Services intentionally handle as much of the claim as they can over the phone. They do this for a lot of reasons, but the biggest, is that they are generally not held accountable for what they say on the phone. They don’t like to put things in writing because letters and emails can be brought up in court later, unlike phone calls.

I can’t stress this enough: When you’re dealing with an insurance claim, get everything in writing. You need a paper trail!

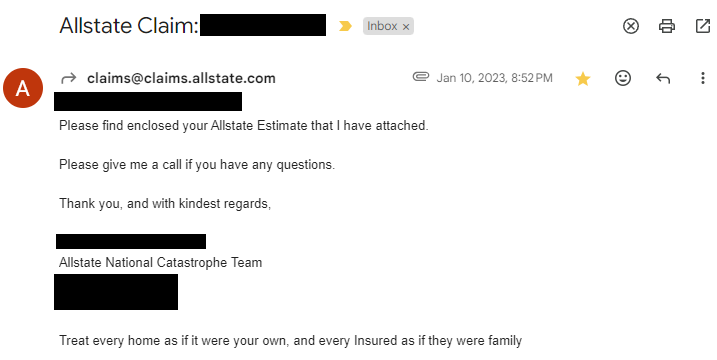

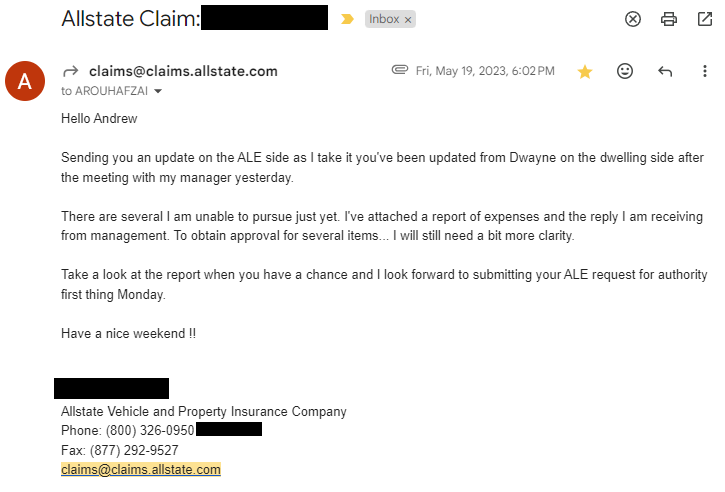

Deny-First Mentality at Pilot

Another thing I learned while working with adjusters at Pilot is that they tend to employ a “deny-first” mentality when I asked for coverage under my policy. In the example above, you can see that the Allstate/Pilot adjuster is basically just acting as a middle-man between me and Allstate. Since he doesn’t work at Allstate, he has to write a business case and seek approval for every single dollar he writes on my claim.

This leads to a difficult reimbursement process, where the insured has to work hard just to get fair coverage.

Even worse, in my example, the email above was dated May 19, 2023, and we were still seeking follow up for receipts submitted in January and February of 2023. Let’s just say this is NOT in line with Allstate’s responsibilities according to the Texas Prompt Payment of Claims Act.

Another example of this “deny first” and “soft denials” was when I asked Allstate to provide coverage for desks for me and my wife. At this point, Allstate had already approved covering the rent for a temporary house, but the house didn’t have any desks. My wife and I both work from home, so we needed to get desks quickly. I looked at renting desks, noticed they were almost $100/week, so I figured it would be smarter to buy cheap desks. It took Allstate over 4 months to agree to cover those desks for me…

Closing

Honestly, this article doesn’t even touch the surface of my disappointment and frustration with Allstate and Pilot Catastrophe Services. Honestly, I shouldn’t be shocked – this is, after all, the same company that hired the McKinsey Consulting Company to intentionally underpay valid insurance claims.

What grinds my gears is that the beginning of your insurance claim is the most important part, but that’s where you get the worst level of service from Allstate, State Farm, and other major insurance carriers.

During the first 3-4 weeks of my claim:

- I didn’t know where to stay/sleep (I couldn’t get a direct approval or denial on my additional living expense coverage)

- I couldn’t get a direct response on whether or not I was allowed to demolish wet/damaged areas of my home

- I wasn’t sure how to proceed or move my claim along, and I wanted to make sure I was handling everything the right way

And I could barely get an adjuster on the phone, and I would only get short sentence responses to my emails!

I hope that if you’re out there, reading this, just know that you’re not alone. We can help.

If you’ve faced similar challenges with Allstate, State Farm, Pilot Catastrophe, or another insurer, share your story in the comments or reach out. Let’s support each other and push for a fairer claims process.

FAQ

Pilot Catastrophe Services is a third-party company that provides independent adjusters to insurance companies like Allstate and State Farm. They step in, especially during high-volume claim periods such as natural disasters, to handle claims on behalf of these insurers. If you’re filing a claim due to a catastrophe, there’s a good chance Pilot’s adjusters will manage your case.

Insurance companies use third-party adjusters to manage a surge in claims, particularly after a catastrophe, due to their scalability and cost-effectiveness. These adjusters offer the manpower and expertise needed to process claims quickly, ensuring policyholders’ cases are handled without significant delays.

Policyholders may experience challenges such as delayed communication, difficulty getting adjusters on the phone, and a lack of personalized attention. Additionally, there can be issues with claim underpayment or denial as adjusters manage high caseloads and strive to minimize costs for the insurance company.

To ensure effective communication, document all interactions, request updates regularly via email for a written record, and be clear and concise in your communications. If necessary, don’t hesitate to escalate your concerns through the insurance company’s customer service channels.

If your claim is denied or underpaid, review your insurance policy to understand your coverage, gather all relevant evidence supporting your claim, and consider writing a formal appeal letter to the insurance company. Seeking advice from a public adjuster or legal counsel can also be beneficial.

To expedite the process, provide all necessary documentation promptly, follow up regularly, and ensure your claim is as detailed and clear as possible. Utilizing digital platforms for document submission can also speed up the review process.

If unsatisfied with your claim’s handling, first try resolving the issue with the adjuster directly. If that fails, escalate your concern to a supervisor at Pilot or contact your insurance company’s customer service to express your dissatisfaction and request further review or a different adjuster.