Table of contents

A Historic Weather Event

A Historic Weather Event

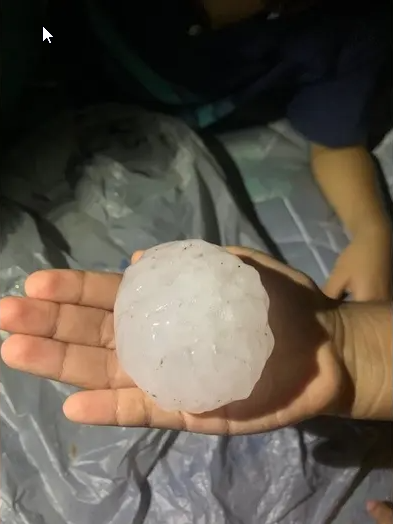

In September 2023, the Austin area and its surrounding regions, particularly Williamson and Travis counties, experienced a weather event of historic proportions. This severe thunderstorm unleashed hailstones the size of baseballs and softballs, a phenomenon rarely seen with such intensity and scale in this region. The sheer size and velocity of these hailstones resulted in an unprecedented level of destruction, marking it as one of the most damaging storms in recent history.

The impact was particularly severe in Round Rock and other parts of the greater Austin area. Homes, vehicles, and infrastructure bore the brunt of the storm’s fury. The hail pummeled roofs, shattered windows, and left vehicles with significant dents and broken glass. This level of devastation not only caused immediate damage but also led to long-term repercussions for the community’s safety and economic stability.

The aftermath of the storm saw neighborhoods grappling with extensive property damage. In Round Rock, streets were littered with debris, and many homes required significant repairs. The cost of these damages, as reported, reached staggering figures, underscoring the storm’s severity and the immense challenge it posed to residents and local authorities alike.

This event serves as a stark reminder of the unpredictable nature of weather in Texas and the importance of being adequately prepared for such extreme events. It also highlights the vital role of comprehensive insurance coverage in mitigating the financial impact of such natural disasters.

The Aftermath: A Financial and Emotional Toll

The Aftermath: A Financial and Emotional Toll

The repercussions of the September 2023 hailstorm in the Austin area were profound, extending beyond the immediate physical damages. According to the National Weather Service, this hailstorm set a new record as the costliest in Austin-area history. The combined damages in Travis and Williamson counties are estimated at a staggering $600 million. This figure not only surpasses previous records by a significant margin but also reflects the extraordinary scale and impact of the storm.

The financial toll of this event was immense. In Round Rock alone, entire neighborhoods faced extensive repairs to homes and vehicles. Local businesses, including car dealerships, suffered severe losses, with inventory damaged or destroyed. The cost of these damages profoundly affected the local economy, disrupting daily life and business operations for many residents.

However, the impact of the hailstorm went beyond financial losses. For many residents, the emotional toll was equally significant. The suddenness and intensity of the storm left lasting impressions on those who lived through it. Families had to navigate the stress and uncertainty of repairing their homes, dealing with insurance claims, and restoring normalcy to their lives. The community faced a period of rebuilding, not just physically but also emotionally, as they recovered from the shock and disruption caused by the storm.

The aftermath of the hailstorm also brought to light the importance of community support and resilience. Neighbors helped each other with clean-up efforts, shared resources, and offered emotional support. Local authorities and organizations stepped in to provide assistance and guidance, showcasing the strength and solidarity of the Austin community in the face of adversity.

This historic event underscored the need for preparedness and the crucial role of adequate insurance coverage. It highlighted the complexities of navigating insurance claims and the importance of having knowledgeable and experienced advocates to assist in the process.

As we reflect on the aftermath of the September 2023 hailstorm, it is clear that its impact was far-reaching, affecting the hearts and homes of many. It stands as a reminder of our vulnerability to natural disasters and the necessity of collective strength and preparedness in overcoming such challenges.

The Challenge of Insurance Claims

The Challenge of Insurance Claims

Even months after the devastating hailstorm, numerous residents across Austin and its surrounding areas find themselves entangled in the complexities of insurance claims. This prolonged struggle highlights a significant and often distressing aspect of recovering from such natural disasters.

Prolonged Processing and Delays: Many homeowners and car owners have reported experiencing frustrating delays in the processing of their claims. The sheer volume of claims submitted in the wake of the storm has overwhelmed many insurance companies, leading to prolonged wait times for assessments and reimbursements. This delay exacerbates the stress for those eagerly awaiting funds to begin repairs and replacements.

Lowball Offers and Negotiation Difficulties: A common grievance among claimants is receiving initial compensation offers from insurance companies that fall drastically short of covering the actual cost of damages. These lowball offers, often a standard practice in the industry, require negotiation skills and a deep understanding of insurance policies to counter effectively. For the average person, this can be a daunting and confusing process.

Lack of Transparency and Communication: Adding to the frustration is a perceived lack of transparency and effective communication from some insurance companies. Policyholders often find themselves in a maze of bureaucratic procedures, struggling to get clear answers and updates on the status of their claims. This lack of clear communication can leave residents feeling helpless and uncertain about their financial recovery.

Expert Guidance as a Necessity: The situation underscores the crucial need for expert guidance in navigating insurance claims. Public adjusters and insurance claim experts like those at Insurance Claim Hero become indispensable in these scenarios. They offer the expertise and advocacy needed to navigate these complex processes, ensuring that claimants receive fair and just compensation. Their role in demystifying insurance policies, negotiating with insurance companies, and providing moral support cannot be overstated.

An Ongoing Struggle for Fairness: The ongoing challenges faced by residents in the aftermath of the hailstorm highlight a broader issue within the insurance industry. It brings to light the need for more efficient, transparent, and fair practices in handling claims, especially in the wake of large-scale natural disasters.

As we continue to witness the struggles of those affected by the September 2023 hailstorm, the importance of having a knowledgeable ally in the complex world of insurance claims becomes increasingly apparent. For many, this assistance can make the difference between a prolonged ordeal and a step toward recovery and normalcy.

Insurance Claim Hero is Here to Help

Insurance Claim Hero: Here to Help

Insurance Claim Hero: Here to Help

At Insurance Claim Hero, we have closely observed the ongoing struggles of individuals and families grappling with the aftermath of the September 2023 hailstorm. Despite not being in operation during the storm, our expertise in the realm of insurance claims uniquely positions us to provide crucial assistance during this recovery phase.

Expertise in Claim Handling: Our team comprises seasoned professionals well-versed in the intricacies of insurance claim processes. We specialize in interpreting policy details, identifying rightful claim amounts, and navigating the complexities that often accompany insurance negotiations. Our expertise becomes a beacon of hope for those feeling overwhelmed by the daunting task of claim settlement.

Advocacy and Representation: Insurance Claim Hero acts as an advocate for policyholders. We understand that facing large insurance companies can be intimidating for individuals. Our role is to level the playing field, ensuring that your voice is heard and your rights are protected. We represent your interests, pushing back against unfair practices and advocating for the compensation you deserve.

Personalized Approach: We recognize that every claim is unique, with its own set of challenges and requirements. Our approach is tailored to meet the specific needs of each client. Whether it’s providing detailed documentation of damages, negotiating with insurance adjusters, or offering guidance on the best course of action, our support is customized to maximize your claim’s success.

Educational Resources: Beyond direct claim assistance, Insurance Claim Hero is committed to educating homeowners and vehicle owners about their insurance rights and how to protect themselves in the future. We provide resources and advice that empower individuals to better understand their policies, what they’re entitled to, and how to prepare for potential future claims.

A Partner in Your Recovery Journey: Our mission extends beyond mere claim settlement; we aim to be a partner in your journey towards recovery. Recognizing the emotional and financial toll of the hailstorm, we strive to alleviate the burden of the claims process, allowing you to focus on rebuilding and moving forward.

Insurance Claim Hero is more than just a public adjusting firm; we are a dedicated ally in these challenging times. For those still facing hurdles with their hailstorm-related insurance claims, we offer our expertise, support, and unwavering commitment to help you navigate these turbulent waters.

Tips for Dealing with Post-Storm Insurance Claims

Expert Tips for Dealing with Post-Storm Insurance Claims

For those in the midst of managing insurance claims from the September 2023 hailstorm, navigating the process effectively is crucial. Here are some detailed tips to help you through this challenging time:

1. Document All Damages Thoroughly:

- Take clear and detailed photographs of all damages, from multiple angles.

- Write down a description of each damage, including the date and time it was discovered.

- If possible, keep samples of materials (like broken shingles) that were damaged.

- Maintain a log of any temporary repairs you make to prevent further damage.

2. Understand Your Insurance Policy:

- Review your policy in detail to understand what types of damage are covered.

- Pay special attention to any exclusions or limitations in your policy.

- Know your deductible and how it applies to your claim.

- If there are terms or clauses you do not understand, seek clarification.

3. Follow Up Regularly:

- Maintain consistent communication with your insurance company.

- Keep a record of all interactions, including dates, names, and what was discussed.

- Ask for updates regularly if your claim is taking longer than expected.

- Be proactive in asking questions about the status of your claim.

4. Seek Professional Assistance:

- Consider consulting with a public adjuster or an insurance claim expert like Insurance Claim Hero.

- An expert can help interpret your policy, assess damages accurately, and negotiate with the insurance company.

- They can also manage the paperwork and follow-ups, reducing your stress and workload.

Looking Ahead: Be Prepared for the Future

The September 2023 hailstorm was a stark reminder of nature’s unpredictability and the impact it can have. Moving forward, it’s important to be prepared for such natural disasters:

- Review and Update Your Insurance Coverage: Regularly reviewing your insurance policy ensures that your coverage meets your current needs and that you are adequately protected against various types of disasters.

- Create an Emergency Plan: Have a plan for your family and property in case of future storms. This includes knowing how to secure your home quickly and having an emergency kit ready.

- Stay Informed About Weather Forecasts: Keeping an eye on weather forecasts can help you prepare for impending severe weather events.

Being well-prepared can significantly mitigate the impact of future natural disasters on your life and property. Understanding your insurance policy, knowing how to document and report damage, and having a plan in place are key steps in ensuring your safety and financial security.

Insurance Claim Hero: Your Advocate in Difficult Times

If you are facing difficulties with your insurance claim from the September 2023 hailstorm, Insurance Claim Hero is here to assist. Our expertise in insurance claims can provide the guidance and support you need to navigate these challenges and seek fair compensation.

FAQ

Document all damages thoroughly with clear, detailed photographs from multiple angles. Write descriptions for each damaged item, including the discovery date and time. Keep samples of damaged materials if possible and maintain a log of temporary repairs.

Understand what types of damage your policy covers, any exclusions or limitations, and your deductible. Review your policy in detail and seek clarification for any terms or clauses you don’t understand.

Maintain regular communication with your insurance company, keeping records of all interactions. Be proactive in asking for updates and clarifications on your claim’s status.

Consider hiring a public adjuster or an insurance claim expert if you’re struggling to interpret your policy, accurately assess damages, or negotiate with your insurance company. Experts can also handle paperwork and follow-ups on your behalf.

Regularly review and update your insurance coverage to match your current needs. Create an emergency plan for your family and property, and stay informed about weather forecasts to anticipate severe weather events.

The combined damages in Travis and Williamson counties from the hailstorm are estimated at approximately $600 million, making it the costliest in Austin-area history.

Residents have reported prolonged processing and delays, receiving lowball compensation offers, and a lack of transparency and effective communication from insurance companies.

Insurance Claim Hero offers expertise in claim handling, acts as an advocate for policyholders, provides personalized support tailored to each client’s needs, and educates individuals about their insurance rights and claim processes.